SIP Calculator

📈 Why You Need an SIP Calculator in India—and How to Use It

🚀 The Fast Lane to Wealth Creation Begins Here through SIP calculator

In a country where financial literacy is growing and the stock market is more accessible than ever, having the right tools to plan your investments is no longer optional—it’s essential. That’s where a Systematic Investment Plan (SIP) calculator comes in. Think of it as Google Maps for your money: input your financial destination (say, ₹50 Lakhs for your child’s education), and the calculator shows you the best path (monthly SIP amount, returns, and time horizon).

🔍 1. Why Use an SIP Calculator in India?

🎯 Visualize Your Financial Future

Let’s say you invest ₹10,000 per month for 15 years in an equity mutual fund with an average return of 12% annually. Instead of guessing, the SIP calculator shows that your money could grow to ₹50.37 Lakhs.

That’s compound interest working for you!

📊 Graphic Idea:

A graph showing investment growth:

- X-axis: Years

- Y-axis: Investment Value

- Milestones: “Today”, “5 Years – ₹8.2L”, “10 Years – ₹23L”, “15 Years – ₹50L+”

💡 Try this on our SIP Calculator:

👉 Use SIP Calculator

🧠 Plan With Precision

Need ₹20 Lakhs for a home down payment in 10 years? Our SIP calculator reverse-engineers this:

✅ Invest just ₹10,000/month at 12%, and you’ll reach your goal.

💬 No more guesswork—just real, achievable targets.

🔄 Compare Multiple Scenarios

What if you:

- Increase SIPs by 10% every year?

- Invest a lump sum of ₹1 Lakh after 5 years?

- Change expected returns from 12% to 10%?

📊 A good SIP calculator lets you simulate these scenarios in seconds.

📊 Graphic Idea:

Side-by-side bar chart comparing:

- Normal SIP

- SIP with 10% yearly increase

- SIP + Lump sum

- SIP with lower return

💪 Build Discipline & Confidence

When you track your investments visually, you’re less likely to panic during market dips. SIP calculators help you stick to the plan and build long-term wealth—slow, steady, and smart.

🧮 2. How Does an SIP Calculator Work?

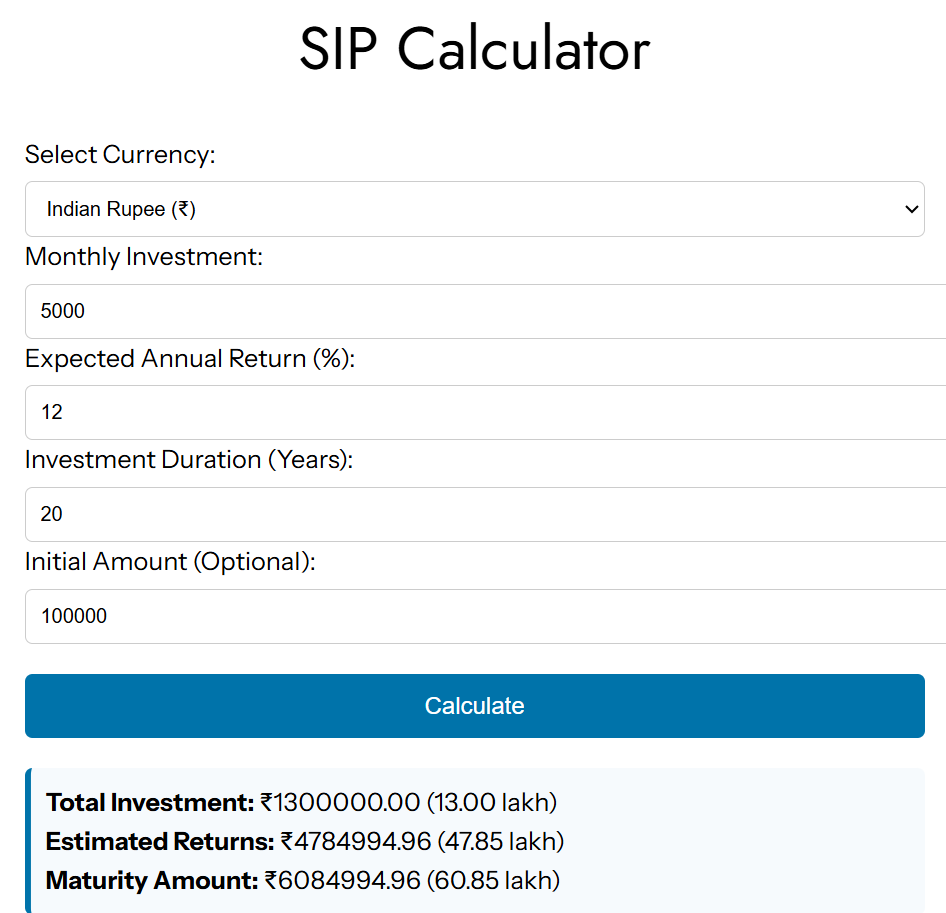

📝 You Enter:

- Monthly SIP amount (e.g. ₹5,000)

- Expected Return (e.g. 12% p.a.)

- Investment Duration (e.g. 20 years)

🔢 It Calculates:

Using the SIP compound interest formula:

javaCopyEditFuture Value = P × ((1 + r)^n – 1) ÷ r × (1 + r)

Where:

- P = Monthly SIP amount

- r = Monthly return rate (Annual ÷ 12)

- n = Total months

⚡ Instantly Shows You:

- Total Invested Amount

- Expected Maturity Amount

- Total Wealth Created (Profit)

🧭 3. Step-by-Step: Using Our Indian SIP Calculator

✅ Visit: https://sipcalculatorfree.in

- Enter Monthly SIP (e.g., ₹8,000)

- Expected Return (e.g., 12% annually)

- Duration (e.g., 15 years)

- (Optional) Add Yearly Top-ups or Lump Sum Investments

📊 Click “Calculate” to see:

- Interactive Chart

- Detailed Summary

- Year-by-Year Table

- Export as PDF

- Share via WhatsApp or Email

👉 Try the SIP Calculator Now: Click Here

💡 4. Pro Tips for Indian Investors

✅ Start Early: ₹5,000/month at age 25 = ₹1.9 Cr by 55

✅ Increase SIP Yearly: Offset inflation

✅ Review Yearly: Adjust goals or returns as needed

✅ Diversify: Use a mix of equity, debt, and hybrid mutual funds

📊 Example Comparison:

| Age | Monthly SIP | Years | Total Corpus |

|---|---|---|---|

| 25 | ₹5,000 | 30 | ₹1.9 Cr |

| 35 | ₹10,000 | 20 | ₹76 Lakhs |

🧠 Lesson: Starting early beats higher amounts later.

🌱 5. Ready to Take Charge?

Your dreams need more than a wish—they need a solid financial plan. Our free, mobile-friendly SIP calculator is designed for Indian investors, with options tailored to your goals.

👉 Use the tool today at sipcalculatorfree.in

No financial background required—just your dreams, and a few clicks.

📌 Final Thought

Every successful investor in India started with a plan. With the SIP calculator, your journey begins with clarity, confidence, and control.

🔗 Try Now: SIP Calculator – Start Planning

✅ Internal Links:

✅ External Links: