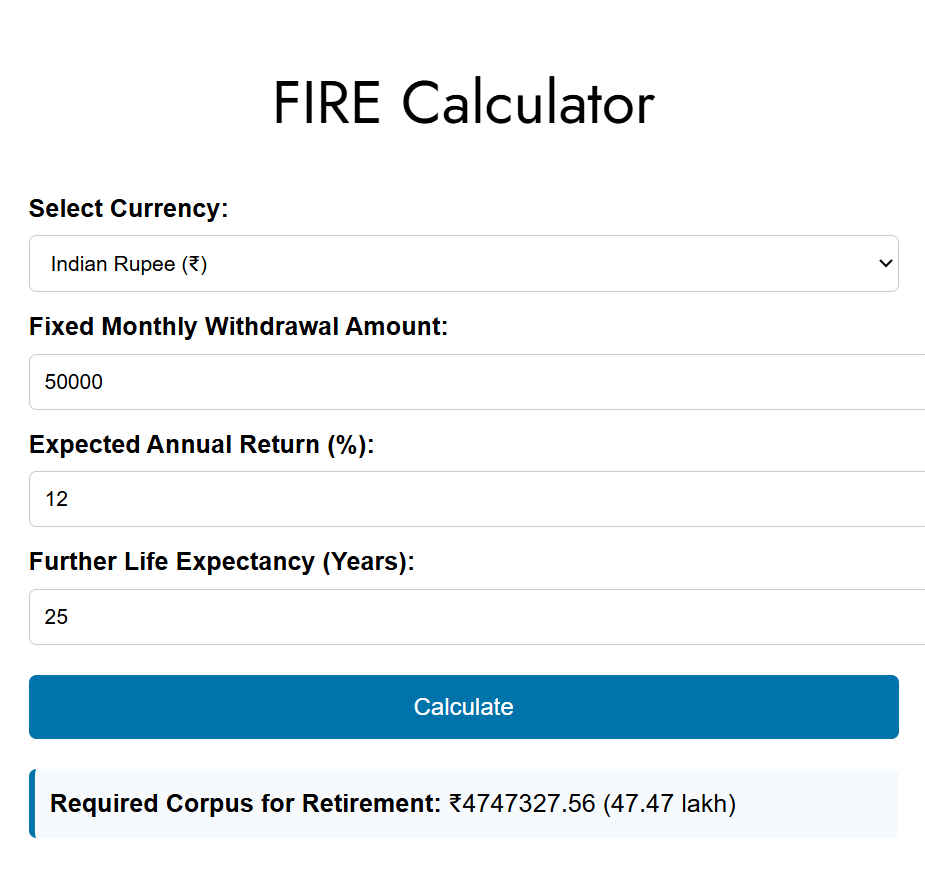

FIRE Calculator

💰 Financial Independence & Early Retirement (FIRE) Calculator – India Edition

Dreaming of retiring by 40 or 50? With the FIRE (Financial Independence, Retire Early) movement catching fire in India, it's time to plan your financial freedom using a powerful yet simple tool — the FIRE Calculator India.

From Mumbai to Bengaluru, more Indians are choosing early retirement with the help of SIP investments, index funds, and real estate. Our FIRE calculator is designed specifically for the Indian audience, with INR currency support and Indian stock market expectations.

🔥 What is a FIRE Calculator?

The FIRE Calculator helps you determine the corpus (retirement fund) you’ll need to retire early in India, while sustaining your desired lifestyle for decades.

It calculates how long your lump sum retirement fund will last, based on:

- Your expected monthly withdrawals

- Expected annual return on investment (e.g., mutual funds, Nifty 50, PPF)

- Your life expectancy

🚀 Why Use a FIRE Calculator in India?

✅ Find your early retirement number in Indian Rupees

✅ Plan retirement in cities like Pune, Hyderabad, or Goa with confidence

✅ Adjust for Indian mutual fund returns (~10-12% p.a.)

✅ Decide if your corpus can withstand inflation & market cycles

✅ Get a visual graph of corpus depletion

Example: Indian FIRE Scenario

Imagine you want to retire at 45 and need ₹50,000/month till age 85.

You expect 10% annual return on your corpus.

👉 Our FIRE calculator shows you’ll need a corpus of approximately ₹1.1 Crores.

You can grow this corpus with a smart SIP in Indian index funds.

📌 Use our SIP Calculator to plan monthly investments toward your FIRE goal.

📊 Key Features of the FIRE Calculator (India-Focused)

🔹 1. Retirement Corpus Estimation (in INR)

Enter how much you need every month post-retirement, expected return, and your retirement duration. Get the required FIRE corpus instantly.

🔹 2. Fixed Monthly Withdrawal Plan

Set a fixed ₹ withdrawal amount (e.g., ₹50,000/month) and see if your corpus will last 30–40 years.

🔹 3. Indian Investment Return Scenarios

Use realistic Indian mutual fund or Nifty returns (8–12% annually) to see how long your funds will last.

🔹 4. Life Expectancy & Retirement Duration

Plan for 30+ years of retirement, especially if you retire in your 40s. Customize your FIRE journey.

🔹 5. Visual Corpus Depletion Graph

See a time-series chart that shows how your FIRE corpus reduces over time with monthly withdrawals.

🔹 6. INR & Multi-Currency Support

Supports ₹INR, $USD, €EUR, £GBP – perfect for NRIs planning retirement in India or abroad.

🔹 7. Export as PDF & Share

Download your FIRE results as a PDF and share via Email or WhatsApp.

🧮 FIRE Corpus Formula (Simplified for India)

We use the present value of annuity formula to calculate your required corpus: Corpus=Withdrawal×[1−(1+monthlyRate)(−months)]/monthlyRateCorpus = Withdrawal × [1 - (1 + monthlyRate)^(-months)] / monthlyRate Corpus=Withdrawal×[1−(1+monthlyRate)(−months)]/monthlyRate

Where:

- Withdrawal = Monthly retirement expense (e.g., ₹50,000)

- monthlyRate = Expected Annual Return / 12 (e.g., 10% ÷ 12 = 0.83%)

- months = Retirement years × 12

📈 How to Use the FIRE Calculator?

Step 1: Enter Retirement Inputs

- Select currency: ₹INR

- Monthly Withdrawal: ₹50,000

- Annual Return: 10%

- Retirement Duration: 40 years

Step 2: Get Instant FIRE Corpus

- Required Corpus: ₹1.1 Crores (example)

Step 3: View Corpus Graph

- Time-series graph showing monthly depletion over 40 years.

Step 4: Export & Share

- PDF download or share via WhatsApp/Email

🔗 Internal Links for Navigation

- 🔸 SIP Calculator for India – Plan your monthly SIP to reach your FIRE corpus

- 🔸 SWP Calculator India – Calculate monthly withdrawals from your corpus

- 🔸 Lump Sum Investment Calculator – Estimate future value of one-time investment

- 🔸 Blog: FIRE Movement in India – Learn how Indians are achieving early retirement

🔗 External Resources for India FIRE Audience

📌 Conclusion: Take Charge of Your Retirement

Retiring early in India is not just a dream, it’s a calculated possibility. Use our India-focused FIRE Calculator to determine your retirement corpus, start your SIPs, and take the first step toward financial freedom.

🔗 Ready to retire early?

👉 Start now with our FIRE Calculator