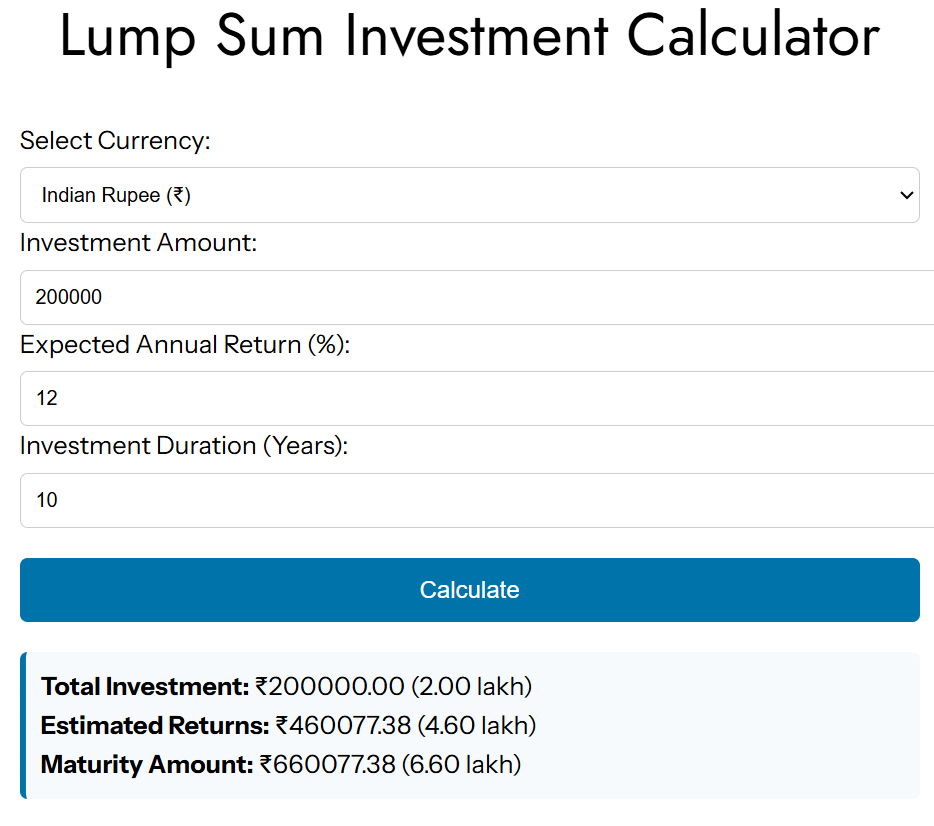

Lump Sum Investment Calculator

💰 Lump Sum Investment Calculator – Plan Your One-Time Investment Smartly in India

Your One-Time Investment, Supercharged for a Wealthy Future

In a world where wealth-building feels uncertain, one simple, powerful tool can give you clarity — the Lump Sum Investment Calculator India. Whether you’re investing ₹50,000 or ₹5,00,000, our tool at SIPCalculatorFree.in helps you forecast the future value of your one-time investment and plan your financial journey with confidence.

Think of it as a financial time machine for your investment — fast-forward your money into the future and see how it can work for you.

🔍 Why Use a Lump Sum Calculator in India?

🎯 Understand the Power of Compounding

Let’s say you invest ₹2,00,000 in a Nifty 50 Index Fund with an average return of 12% per annum. Here’s how your wealth could grow over time:

| Years | Future Value (₹) |

|---|---|

| 5 | ₹3,52,447 |

| 10 | ₹6,24,315 |

| 15 | ₹11,05,401 |

| 20 | ₹19,57,299 |

| 25 | ₹34,67,412 |

| 30 | ₹61,43,672 |

📌 FIRE India Tip: A one-time ₹2 lakh investment can potentially become ₹60+ lakhs in 30 years with disciplined investing and zero emotional trading.

🧠 Plan Long-Term Goals with Accuracy with

Whether it’s your child’s education, retirement planning, or aiming for financial independence, this tool breaks down your financial goals into easy, understandable numbers.

- 🎯 Goal: ₹50 Lakhs

- 💸 Investment: ₹5 Lakhs

- 📈 Expected Return: 12%

- ⏳ Years to Reach Goal: ~23 Years

Use this calculator to reverse-engineer your dreams.

🔄 Compare Scenarios with Ease

Want to see how small changes in return or duration affect your corpus?

Compare these quickly:

- 10% vs. 12% returns

- ₹2L vs. ₹3L invested

- 20 years vs. 25 years

📊 Graphic Tip: Bar chart showing future values at different combinations of amount and return.

💪 Stay Confident & Focused

Visualizing how your investment grows builds patience. That’s the FIRE mindset (Financial Independence, Retire Early): Stay invested, ignore short-term noise, and trust the plan.

🧮 How Does the Calculator Work?

📝 You Provide:

- Lump Sum Amount (e.g., ₹2,00,000)

- Annual Return % (e.g., 12%)

- Investment Duration (e.g., 30 years)

🔢 We Calculate:

Compound Interest Formula:

Future Value = P × (1 + r)^n

Where:

P = Initial Investment

r = Return Rate

n = Years Invested

🧭 Step-by-Step: Using Our Calculator

- ✅ Visit: https://sipcalculatorfree.in

- ✅ Go to: Lump Sum Calculator

- ✅ Enter: ₹ Amount, Return %, Duration

- ✅ Click: “Calculate”

- ✅ View Instant Projections

- ✅ Share via Email or WhatsApp

- ✅ Export PDF Report

🎯 Bonus: Check out our SIP Calculator to compare monthly SIPs vs one-time investments.

💡 Pro Tips for Indian FIRE Aspirants

✅ Start Early — compounding favours time.

✅ Reinvest Dividends — maximise returns.

✅ Avoid Emotional Investing — time in the market > timing the market.

✅ Pick Mutual Funds With Proven Track Record — explore large-cap funds, Nifty 50 index, HDFC Flexi Cap, etc.

🔥 FIRE India Scenario:

| Start Age | Amount Invested | Years | Future Value |

|---|---|---|---|

| 30 | ₹2L | 30 | ₹61.4 Lakhs |

| 35 | ₹2L | 25 | ₹34.6 Lakhs |

| 40 | ₹2L | 20 | ₹19.5 Lakhs |

📌 Start early, invest smart — even small lump sum amounts can lead to huge future returns.

🌱 Ready to Grow Your Wealth?

Your financial freedom journey begins today. Use our Lump Sum Investment Calculator to eliminate guesswork and plan your future with confidence.

👉 Try It Now at https://sipcalculatorfree.in/lumpsum-calculator

🔗 Explore More Tools:

🌐 External Resources

- SEBI – Mutual Fund Regulations

- AMFI India – Association of Mutual Funds

- RBI – Financial Planning Guidelines

📌 Final Thought:

“You don’t need to be rich to start investing. You need to start investing to become rich.”

A single decision can change your future. Make your move with confidence.